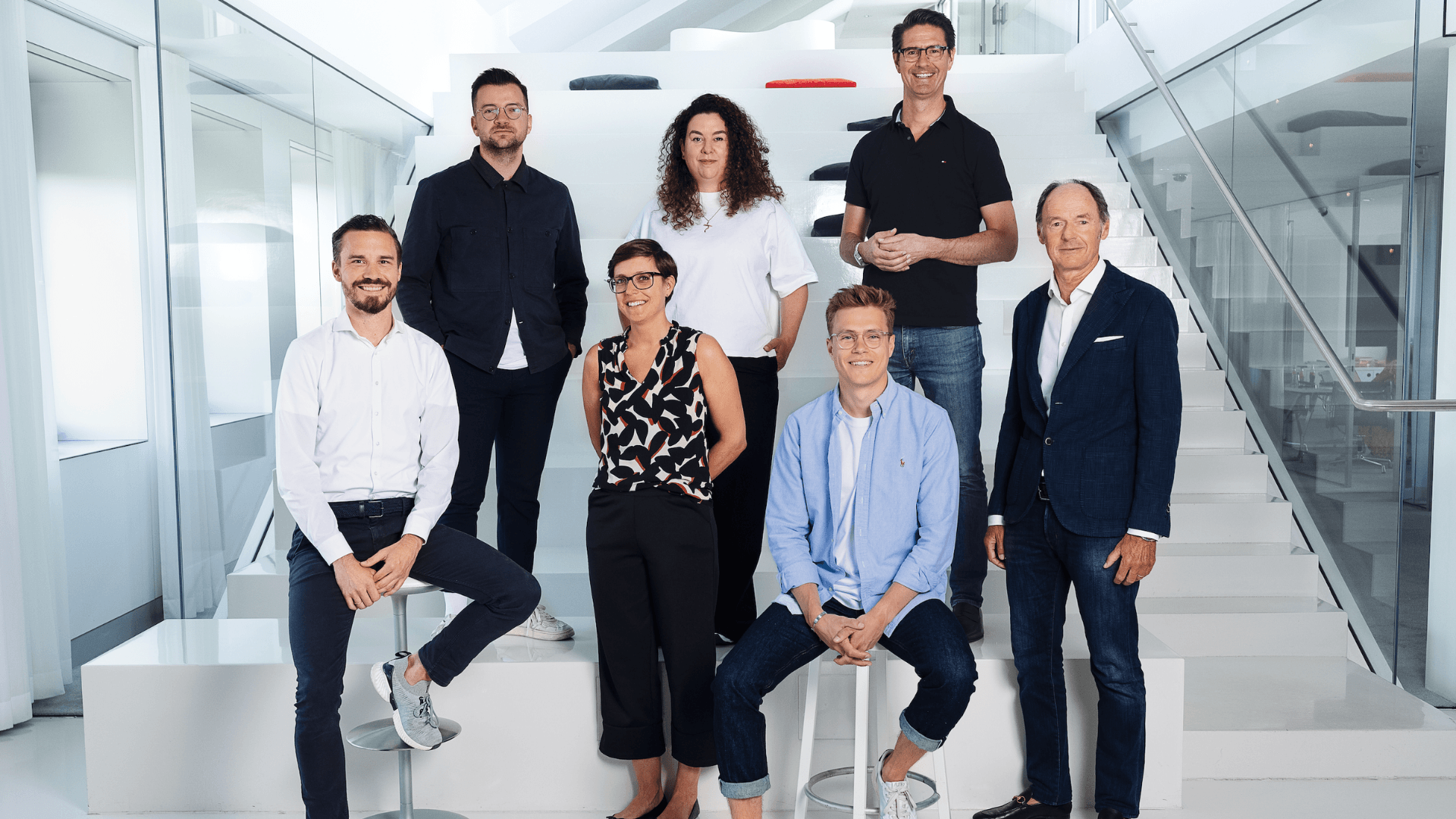

With cheque sizes ranging from €2 million to €5 million, Capmont aims to partner with founders at the late seed to Series B stages, focusing on businesses that demonstrate early traction and a solid customer base. The firm’s expertise spans several sectors, including software-defined hardware, industrial technology—encompassing supply chain, manufacturing, and IoT—enterprise SaaS, robotics, and cybersecurity.

Capmont Technology is distinguished by its commitment to investing exclusively in sustainable businesses that offer clear return on investment (RoI) and genuine value to their customers. Beyond financial backing, the firm emphasizes its role in supporting founders through their go-to-market strategies, leveraging both its engineering acumen and the practical experiences of its team.

Dr. Torsten Kreindl, Managing Partner at Capmont Technology, articulated the firm’s ethos: “The start-up space is known for being extremely competitive, but it can also be hugely collaborative. Our aim is to offer founders an unmatched network, and we go above and beyond to help them succeed. Rather than deploying capital and hoping for the best, we commit to supporting entrepreneurs longer-term—whether that comes in the form of introducing them to decision-makers and potential customers, or another injection of funding when the time is right.”

Dr. Matthias Roth, Partner at Capmont Technology, echoed this sentiment, emphasizing the firm’s focus on impactful investments: “There are many exciting opportunities to invest in industrial technology applications that truly make an impact while generating superior returns for investors. That’s precisely what this fund focuses on. We’re eager to work with more founders who are fuelled by a strong economic equation where costs are balanced, resources optimized, and nothing is wasted—leading to maximum impact.”

Editorial Opinion

Capmont Technology’s recent fundraising initiative positions it as a key player in the venture capital landscape, particularly within the B2B technology sector. The firm’s focus on sustainable and impactful startups is not just timely but essential in an era where businesses are increasingly held accountable for their environmental and social footprints. As industries grapple with challenges such as digital transformation and sustainability, Capmont’s commitment to backing companies that offer innovative solutions reflects a forward-thinking approach that many investors would do well to emulate.

Moreover, the hands-on support that Capmont provides to its portfolio companies is a testament to its dedication to fostering genuine growth and success. By not only providing capital but also strategic guidance and access to an extensive network, Capmont Technology is positioning its founders for long-term viability in a competitive landscape. The companies it chooses to invest in, such as Konux, Plume, and ProGlove, are already making waves in their respective fields. With such a robust support structure, Capmont is likely to nurture the next wave of industry leaders who will drive technological advancement and sustainable practices.

If you need further assistance or have any corrections, please reach out to editor@thetimesmag.com.