osapiens, a frontrunner in ESG (Environmental, Social, and Governance) compliance and sustainability reporting solutions, has announced the successful closure of a $120 million Series B funding round. The investment was spearheaded by Growth Equity at Goldman Sachs Alternatives, marking a significant milestone for the company. This new capital infusion is set to propel osapiens into an accelerated phase of international expansion and technological advancement.

The latest funding round also saw Goldman Sachs Alternatives acquire a minority stake in osapiens, complementing the ongoing support from existing investor Armira Growth, who led the previous $27 million Series A round in 2023.

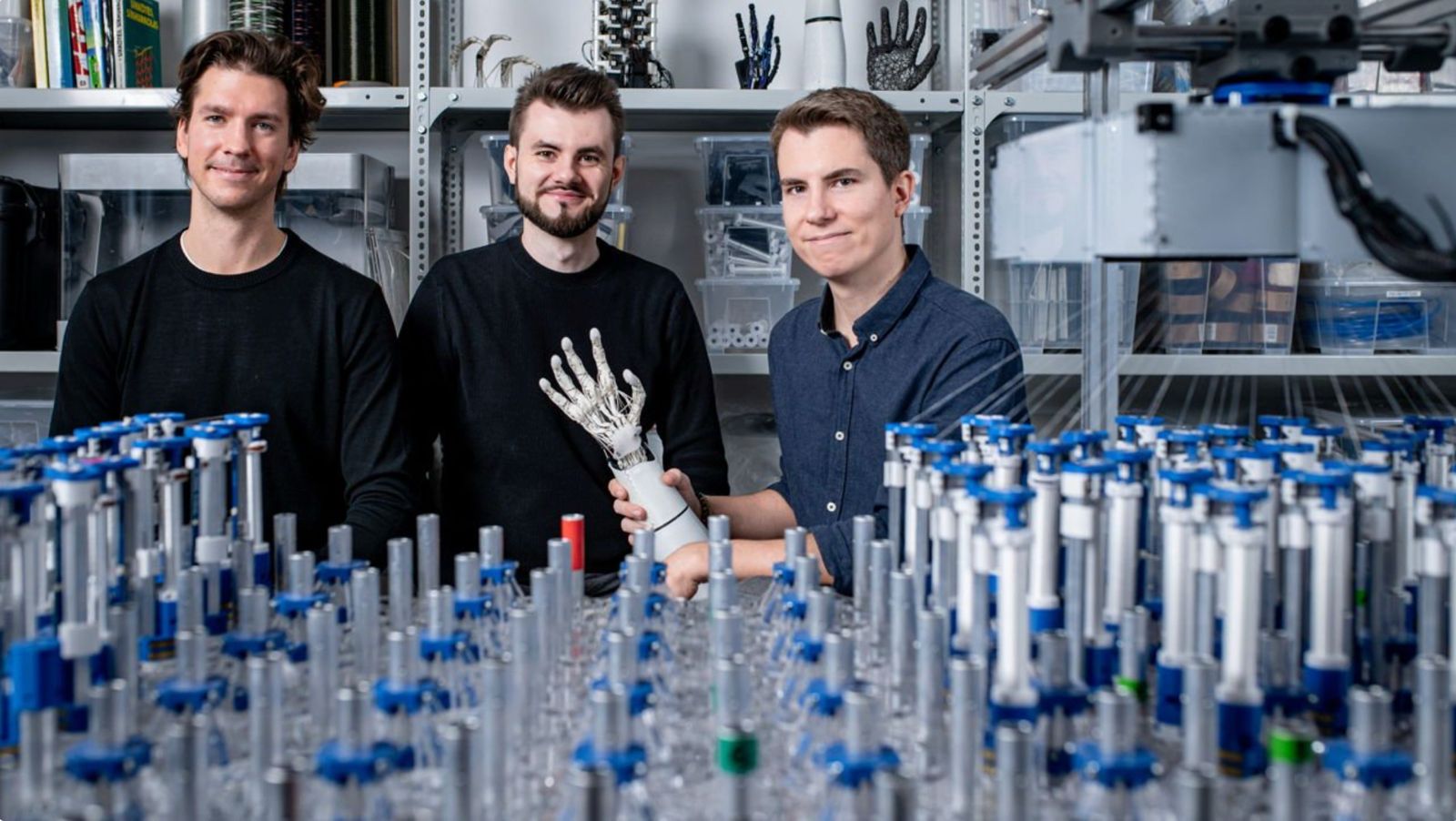

osapiens, established in Mannheim in 2018 by Alberto Zamora, Stefan Wawrzinek, and Matthias Jungblut, has quickly ascended to prominence within the ESG technology landscape. Its flagship product, the osapiens HUB, is an AI-powered, cloud-based platform designed to streamline compliance with a broad spectrum of international ESG regulations. These include the Corporate Sustainability Reporting Directive (CSRD), the European Union Deforestation-free Regulation (EUDR), and the Corporate Sustainability Due Diligence Directive (CSDDD). The osapiens HUB stands out for its ability to integrate compliance, risk mitigation, and operational efficiency modules, offering a unified platform that delivers real, actionable impact.

Alberto Zamora, Co-Founder and CEO of osapiens, expressed enthusiasm about the new partnership: “We are thrilled to be working with Goldman Sachs. Their support underscores our leadership position in the dynamic ESG compliance and process efficiency market. We are proud to offer a comprehensive platform that simplifies navigating complex ESG regulations and supports our clients in making a positive impact on their financial performance and the environment.”

Goldman Sachs Alternatives’ Managing Director in Growth Equity, Alexander Lippert, highlighted the value osapiens provides: “osapiens creates extraordinary value for their customers by facilitating compliance with increasing regulatory demands while simultaneously driving tangible business benefits. We are excited about the vast potential of osapiens and pleased to support their mission further.”

The recent funding is set to bolster osapiens’ growth trajectory, which has been marked by a remarkable 473% increase in its customer base throughout 2023. With over 1,300 clients—including industry giants like Bosch, Coca Cola North America, and Costco—the company is poised to enhance its global footprint and technological capabilities.

Editorial Opinion:

osapiens is strategically positioned at the nexus of technology and sustainability, reflecting a growing global emphasis on environmental responsibility. Their innovative approach to ESG compliance not only streamlines complex regulations but also drives operational efficiencies that are crucial in today’s business environment. The recent $120 million funding round is a testament to their impressive growth and the significant value they deliver to their clients.

The company’s potential for impact extends beyond compliance. By offering a platform that integrates various aspects of ESG requirements into a single, user-friendly system, osapiens is setting a new standard in the industry. Their forward-thinking solutions align well with the global push for more transparent and accountable corporate practices. As they continue to expand their market reach and enhance their technology, osapiens is well-positioned to lead the charge in advancing ESG standards worldwide. This investment not only fuels their growth but also signifies a robust endorsement of their innovative vision and commitment to sustainability.

For further inquiries or corrections, please contact editor@thetimesmag.com.