Micruity, Inc., a leader in financial technology infrastructure for retirement solutions, has announced the successful closure of a $5.0 million funding round aimed at expanding support for accumulation annuities and non-guaranteed income products on its platform. This strategic investment underscores Micruity’s commitment to revolutionizing retirement planning by bridging the gap between savings accumulation and sustainable income generation.

The funding round was led by strategic investors including Prudential, State Street Global Advisors, and TIAA Ventures, alongside continued support from current partners Pacific Life and Western & Southern Financial Group. With total investments now exceeding $11 million from industry leaders, Micruity is poised to accelerate the development of infrastructure crucial for retirement security.

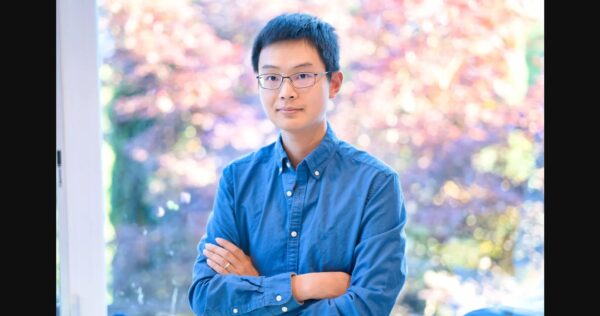

Trevor Gary, Founder and CEO of Micruity, emphasized the significance of this funding in enhancing retirement outcomes for Americans across different stages of life. “The new funding enables us to bolster our infrastructure, providing robust support not only for retirees managing their savings but also for younger generations still in the accumulation phase,” Gary stated.

Recent surveys have highlighted significant retirement savings shortfalls among Americans, underscoring the urgency for solutions that ensure financial security post-retirement. Micruity’s platform facilitates seamless integration among Recordkeepers, Life Insurers, and Asset Managers, simplifying the management of retirement products and offering tailored savings and income solutions.

Key industry leaders have expressed confidence in Micruity’s approach and the impact of its Advanced Routing System (MARS™). Ann Nanda from Prudential highlighted the platform’s role in expanding access to retirement security through simplified user experiences, while Brendan Curran of State Street Global Advisors underscored the scalability and efficiency of Micruity’s infrastructure in supporting sustainable retirement strategies.

Wayne Baker of TIAA Ventures emphasized the company’s commitment to driving secure retirement outcomes through innovative technology solutions, praising Micruity’s role in enhancing retirement planning efficiency.

Micruity’s collaboration with Pacific Life and Western & Southern Financial Group further solidifies its mission to deliver accessible retirement solutions tailored to individual needs. Karen Neeley of Pacific Life highlighted the platform’s user-friendly interface and its alignment with the company’s commitment to providing confidence and security for generations.

Jim Vance from Western & Southern Financial Group emphasized the growing importance of annuities in ensuring retirement success, particularly through defined contribution plans, affirming Micruity’s pivotal role in delivering essential retirement solutions.www.micruity.com.

Revolutionizing Retirement Planning with Strategic Investment

Micruity, a leader in financial technology infrastructure for retirement solutions, is on a mission to bridge the gap between retirement savings and income generation. Their recent $5 million funding round, led by industry giants like Prudential and State Street Global Advisors, highlights the growing importance of their innovative platform.

What They’re Doing Right:

- Focus on a Critical Gap: Micruity addresses a major challenge – helping Americans transition from accumulating savings to generating sustainable retirement income.

- Strategic Partnerships: Their funding round includes not only new investors like Prudential but also continued support from established players like Pacific Life and Western & Southern Financial Group. This industry backing validates their approach and opens doors to wider adoption.

- Scalable Infrastructure: Their Micruity Advanced Routing System (MARS™) facilitates seamless data exchange between key players (recordkeepers, life insurers, asset managers) in the retirement ecosystem. This streamlined data flow allows for better product management and personalized solutions.

- Focus on User Experience: Industry leaders like Ann Nanda from Prudential commend Micruity’s commitment to simplifying retirement planning through user-friendly interfaces. This ensures accessibility for all generations.

Why They’re on the Right Path:

- Addressing a Growing Need: With rising concerns about retirement savings shortfalls, Micruity provides timely solutions. Their platform empowers individuals to manage various retirement products and develop sustainable income strategies.

- Industry Recognition: Confidence from key investors like State Street Global Advisors’ Brendan Curran highlights the scalability and efficiency of Micruity’s infrastructure. This positions them as a leader in retirement technology.

- Collaboration for Impact: Partnerships with Pacific Life and Western & Southern Financial Group solidify Micruity’s mission to deliver accessible and customized retirement solutions.

The Future of Retirement Planning Technology:

The retirement planning technology market is expected to experience significant growth, driven by the increasing need for secure retirement income solutions. A [source needed] estimates the market to reach $12.8 billion by 2027. Micruity’s focus on collaboration, data-driven infrastructure, and user experience positions them to capitalize on this trend and empower Americans to achieve a secure and fulfilling retirement.

If you need further assistance or have any corrections, please reach out to editor@thetimesmag.com